Online & Mobile Banking

CHECK OUT OUR MOBILE APP

Face & Touch Login

Transactions are easy and secure with Face & Touch ID.

eStatements & Tax Documents

Get up to 24 months of eStatements and tax documents for your accounts.

Mobile Check Deposit

Deposit a check on your mobile device easily by taking a picture of it.

Account Alerts

Set up custom alerts to know everything about your account wherever you are.

Transfer Funds

Transfer funds to your accounts and Go Energy members or use Zelle to send it to external accounts.

Update Personal Info

Update your personal info, such as address, email, or phone on the go.

Online Banking

Did you know you can access your account 24/7/365 with our mobile and online banking services?

We’re here for you and with you all the time. Want to check your account activity on your computer or mobile device? Boom. Transfer funds? Boom again. Pay bills? So much booming.

For all the details, please read our online banking agreement.

Mobile Deposit

Have a check you need to deposit? Bypass the branch, avoid the ATM, say no to the night drop, stash your envelope, and stamp. With our mobile app and your device’s camera, snap a couple photos of your check, enter the deposit details into the app, submit, and done! That’s it.

What are you going to do with all that free time?

Here’s one note about processing and funds availability: mobile deposits made before 3:00 p.m. Monday–Friday are available same day. Deposits made after 3:00 p.m. weekdays or on weekends will be available on the next business day after 4:30 p.m.

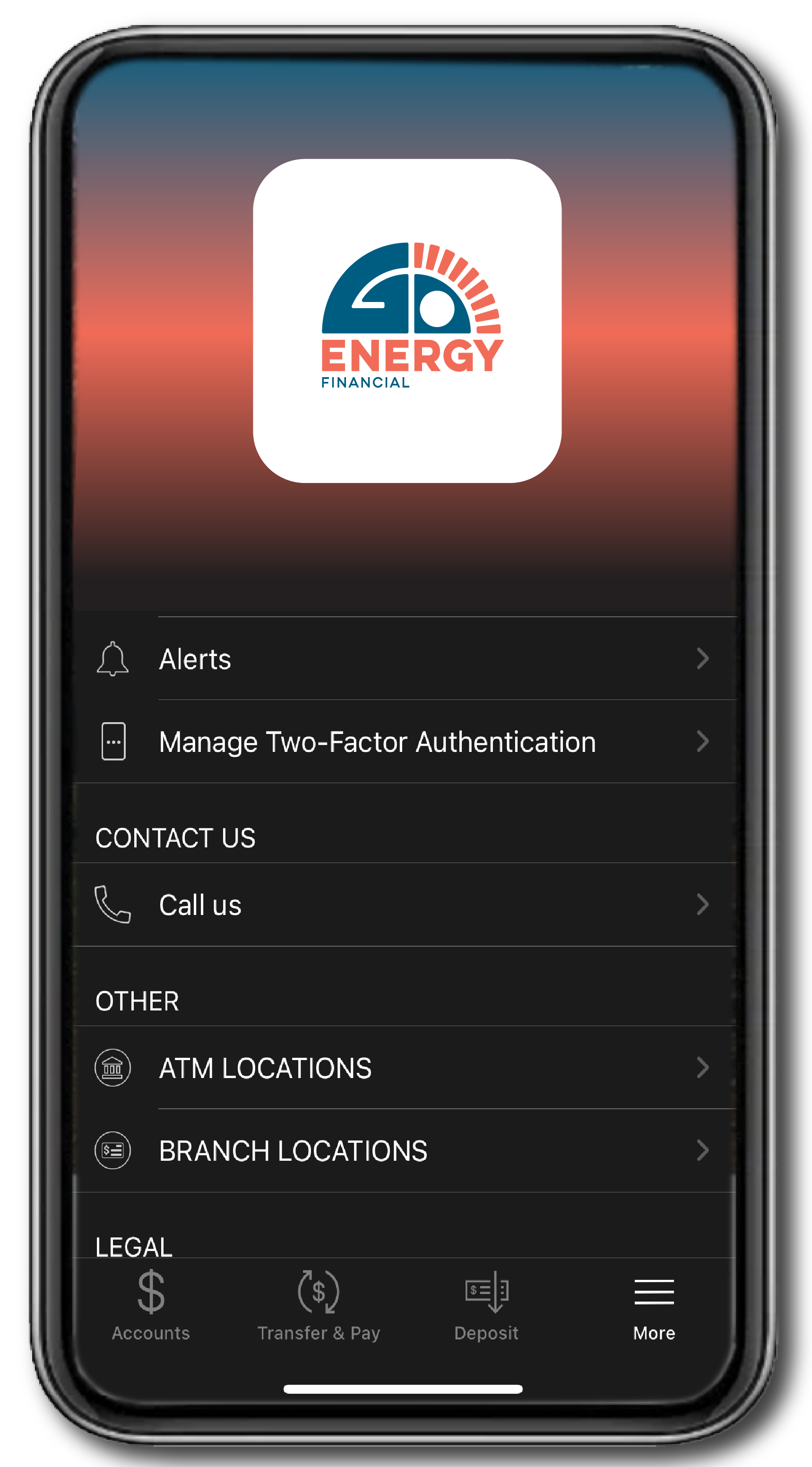

Mobile App Demo

Frequently Asked Questions About Mobile Deposit

E-Statements

Monthly account statements printed on paper and sent via snail mail are a thing of the past. Like rotary phones, popcorn ceilings, and 80s hair metal bands. Let’s all move into the here and now.

Here’s Why to Make the Leap to E-statements

Secure — E-statements live inside our password-protected online banking system and all information is encrypted. The risk of paper statements being stolen is eliminated.

Environmentally Friendly — No paper statements = more trees.

Convenient — Your e-statements are always available for viewing, printing, or downloading. Past statements are archived for easy access. No more overflowing shoeboxes.

Available Early — Your e-statements will be ready up to two days earlier than mailed statements. No bash on the post office… electrons move faster than delivery trucks.

Free — Bigger, better, faster, and free. It’s hard to argue with that.

How to Sign Up for E-Statements

Sign up for e-statements through online banking. You say you’re not an online banking user yet? That’s where you should start, because that’s where you’ll view your e-statements. Once you’re enrolled and logged in, go to accounts and choose one of yours. Click the online statements link and follow the prompts. And be sure to check out our E-Statement Usage Agreement.

Up to a year’s worth of your e-statements will be available for viewing immediately after enrolling. From this point on, you’ll receive an email notification each month when a new statement is available.